画像をダウンロード yield to maturity formula excel download 323393-Yield to maturity formula excel template

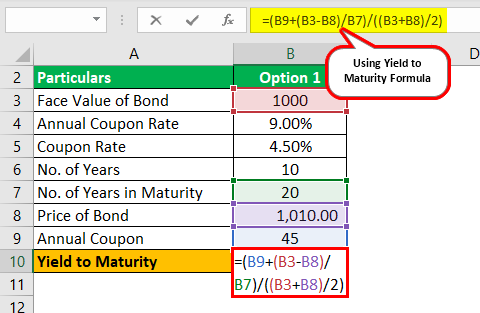

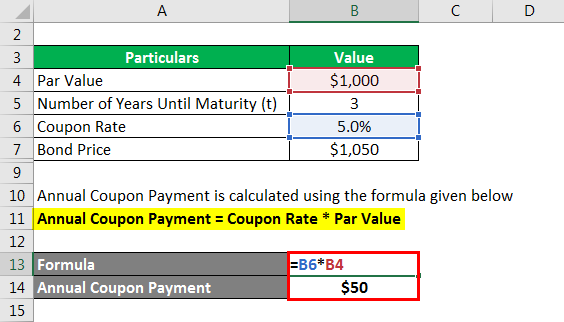

Yield to Maturity is calculated using the formula given below YTM =Coupon Prorated Discount /(Redemption Price Purchase Price)/2 YTM = 630 ($1350 / 5) / ($104 $90) / 2Exceltemplatesorg – For investors, Bond Yield to Maturity Calculator is an important tool which can assist them in calculating their earnings once they have bought today's bond This calculator can be made by putting on the required data and formulas manually in Microsoft Excel worksheets;Or if you want to make it simpler, you can go

How To Calculate Bond Price In Excel

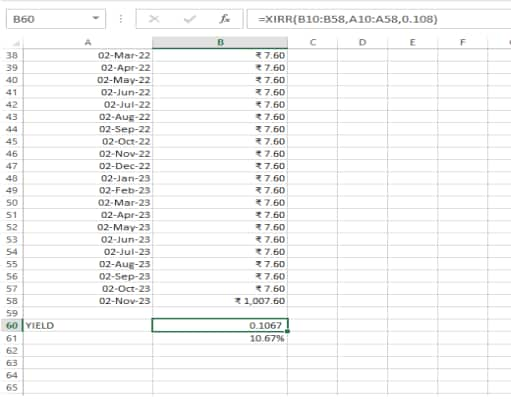

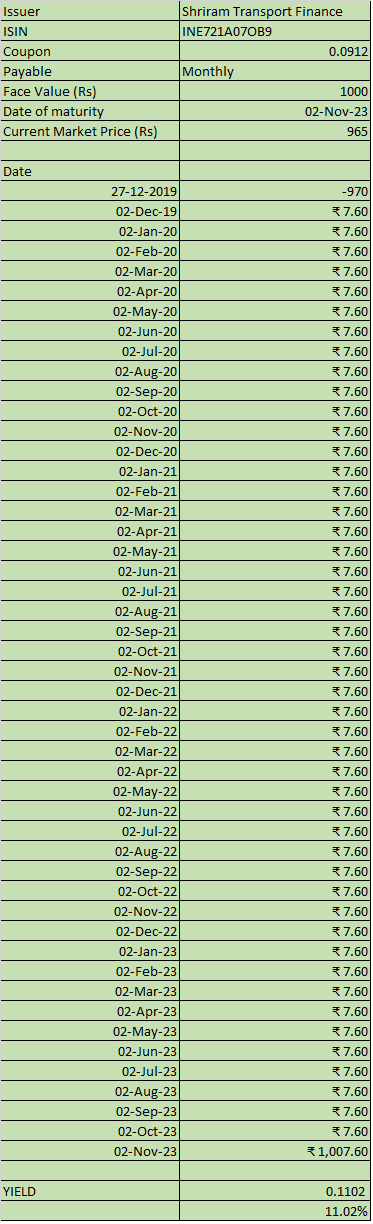

Yield to maturity formula excel template

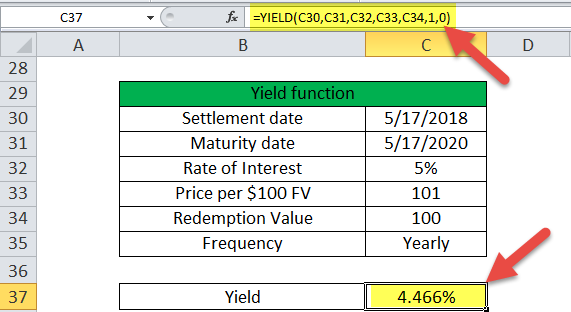

Yield to maturity formula excel template-Use the Yield Function to Calculate the Answer Type the formula "=Yield(B1,B2,,B4,B5,B6,)" into cell B8 and hit the "Enter" key The result should be percentwhich is the annual yield to maturity of this bondYrs to maturity 580 Excel calculation for yield show 3426% (using YIELD(settlement,maturity,rate,pr,redemption,frequency,basis) When you ask a question about Excel usage, it is important to show us how you are using Excel the actual formulas and constants

How To Calculate Yield To Maturity In Excel With Template Exceldemy

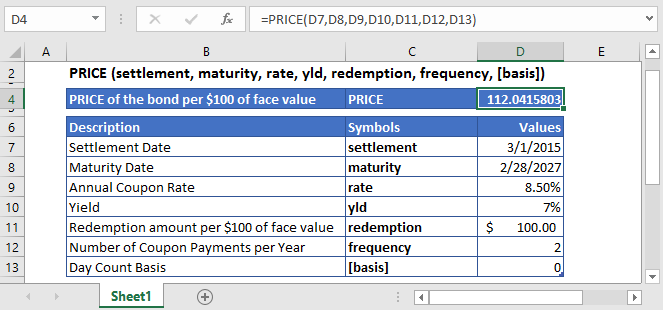

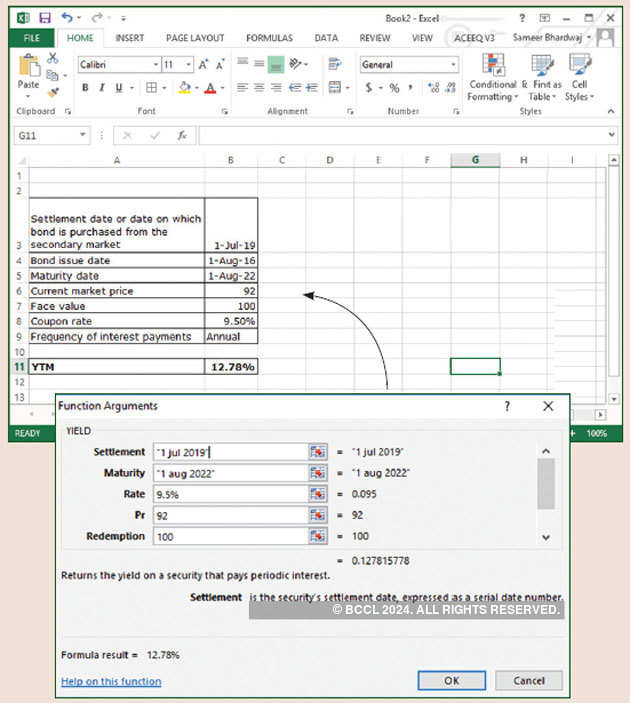

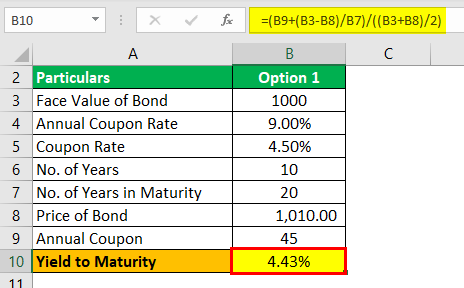

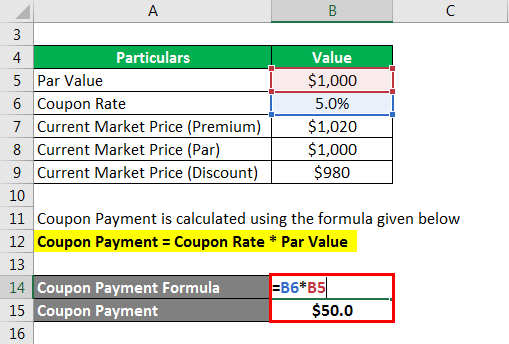

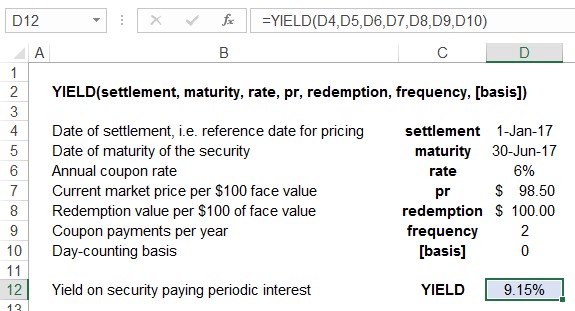

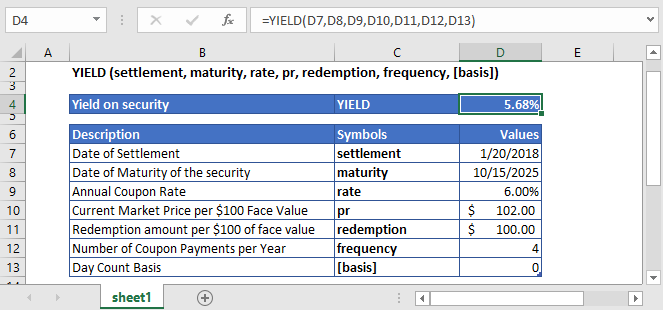

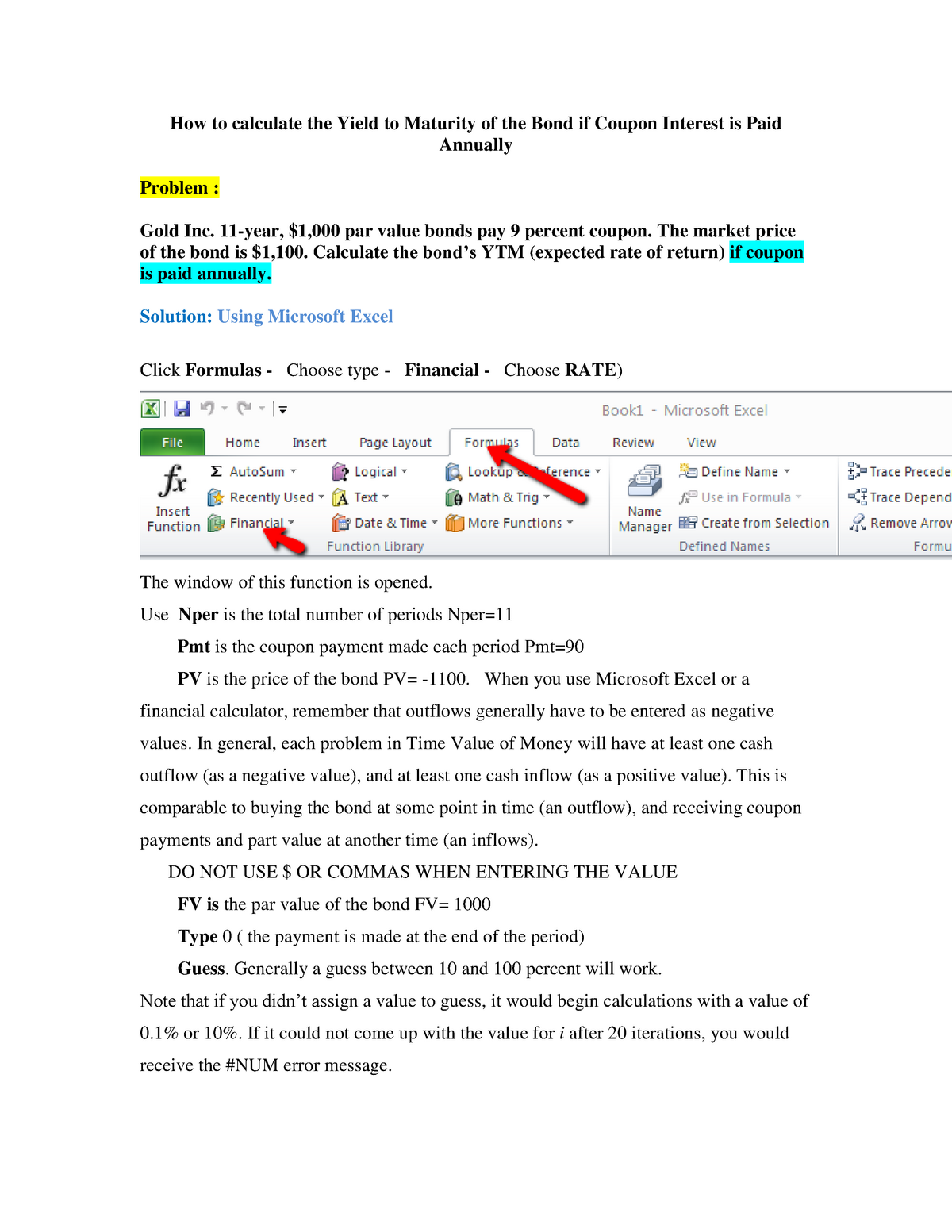

If Coupon Rate Is More Than Yield To Maturity Provided by discountcabincom FREE Yield to Maturity (YTM) Overview, Formula, and Importance Provided by corporatefinanceinstitutecom FREE The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 yearsYield to Maturity Formula refers to the formula that is used in order to calculate total return which is anticipated on the bond in case the same is held till its maturity and as per the formula Yield to Maturity is calculated by subtracting the present value of security from face value of security, divide them by number of years for maturity and add them with coupon payment and after that dividing the resultant with sum of present value of security and face value of security divided by 2Calculate Yield of a 10 Year Bond Now let's calculate the yield of a 10year bond, which was issued on February 1, 09, and was purchased by the investor three months later Other details of the bond are mentioned in the above table The formula used to calculate the Yield is =YIELD(C4,C5,C6,C7,C8,C9,C10) The YIELD function calculates the

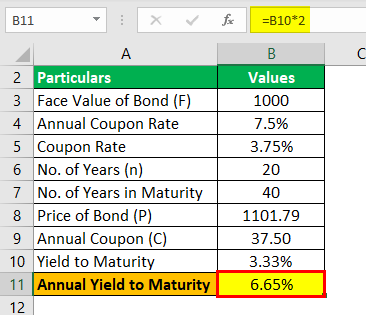

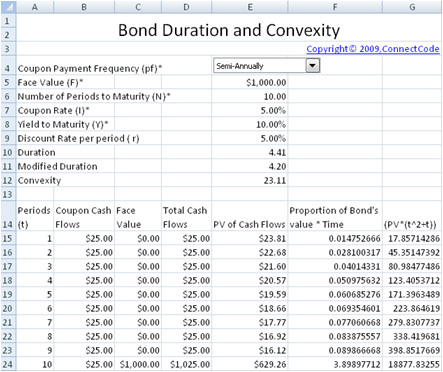

Yield to Maturity (YTM) Formula Excel Template Prepared by Dheeraj Vaidya, CFA, FRM visit email protected Particulars Values Face Value of Bond (F) 1000 Annual Coupon Rate 8% No of years in Maturity (n) 12 Price of the Bond (P) 940 Annual Coupon (C) 8000 Yield to Maturity 876% Assume that the price of the bond is $940 with the face valueYield to Maturity Formula The formula to calculate YTM is as follows Yield to Maturity Example Let's say you're thinking about purchasing a bond that's priced at $1,000 and has a face value of $1,500 The bond will mature in 6 years and the coupon rate is 5% To determine the YTM, we'll use the formula mentioned aboveI've had numerous requests to show how the constant yield rate for debt cost amortization is computed in the sample Excel effective interest method calculations The idea is pretty simple once you have the formulas set up The objective is to determine the rate that drives the amortization balance to zero on the maturity date of the note

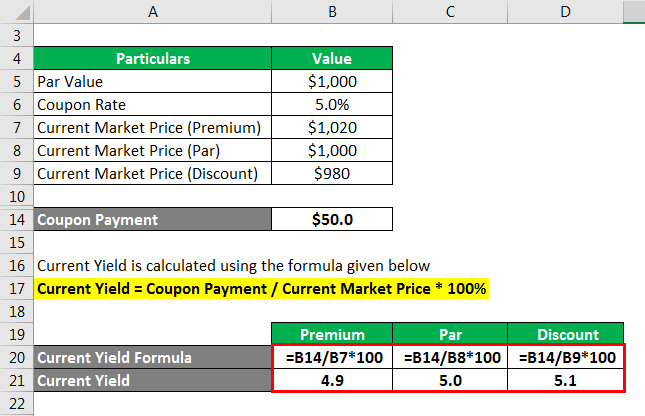

If Coupon Rate Is More Than Yield To Maturity Provided by discountcabincom FREE Yield to Maturity (YTM) Overview, Formula, and Importance Provided by corporatefinanceinstitutecom FREE The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 yearsThe YIELDMAT function is categorized under Excel FINANCIAL functions Functions List of the most important Excel functions for financial analysts This cheat sheet covers 100s of functions that are critical to know as an Excel analyst It will return the annual yield of a security that pays interest at maturityCurrent yield is the annual return on how much you paid for a bond The yield to maturity is the rate of return you receive by holding a bond until it matures The YIELD function in Excel calculates yield to maturity (the calculation for current yield is much more simple) The formula for yield to maturity is much more complex

Yield Function In Excel Calculate Yield In Excel With Examples

How To Calculate Bond Price In Excel

Freeware 10 Excel Sheet Unlocker Downloads at Download That The Bond Yield to Maturity calculator for Excel and OpenOffice Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity Bond Yield Calculator, Corrupt xlsx2csv, BulkPDFYield to Maturity Type This Bond Valuation spreadsheet distinguishes between the Annual Percentage Rate and the Effective Annual Rate When people talk about yield to maturity, they typically refer to the Annual Percentage Rate The Effective Annual Rate basically takes into account the effect of compounding interests of the coupons OutputR is the discount rate or yield to maturity;

How To Calculate Bond Price In Excel

Professional Bond Valuation And Yield To Maturity Spreadsheet

This formula can be rearranged to give the number of payments n The bond pricing equation cannot be rearranged to give an explicit equation for the interest rate Numerical techniques are required to backsolve the equation for the yield to maturity, given the coupon, face value and payment frequencyThe Excel YIELDDISC function returns the annual yield for a discounted security, such as a Treasury bill, that is issued at a discount but that matures at face value Excel YIELDMAT Function The Excel YIELDMAT function returns the annual yield of a security that pays interest at maturity= YIELD (settlement, maturity, rate, pr, redemption, frequency, basis) This function uses the following arguments Settlement (required argument) – This is the settlement date of the security It is a date after the security is traded to the buyer that is after the issue date

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

There is no formula that can be used to calculate the exact yield to maturity for a bond (except for trivial cases) Instead, the calculation must be done on a trialanderror basis This can be tedious to do by handThe formula to price a traditional bond is Calculating the Yield to Maturity in Excel The above examples break out each cash flow stream by year This is a sound method for most financialThis article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)

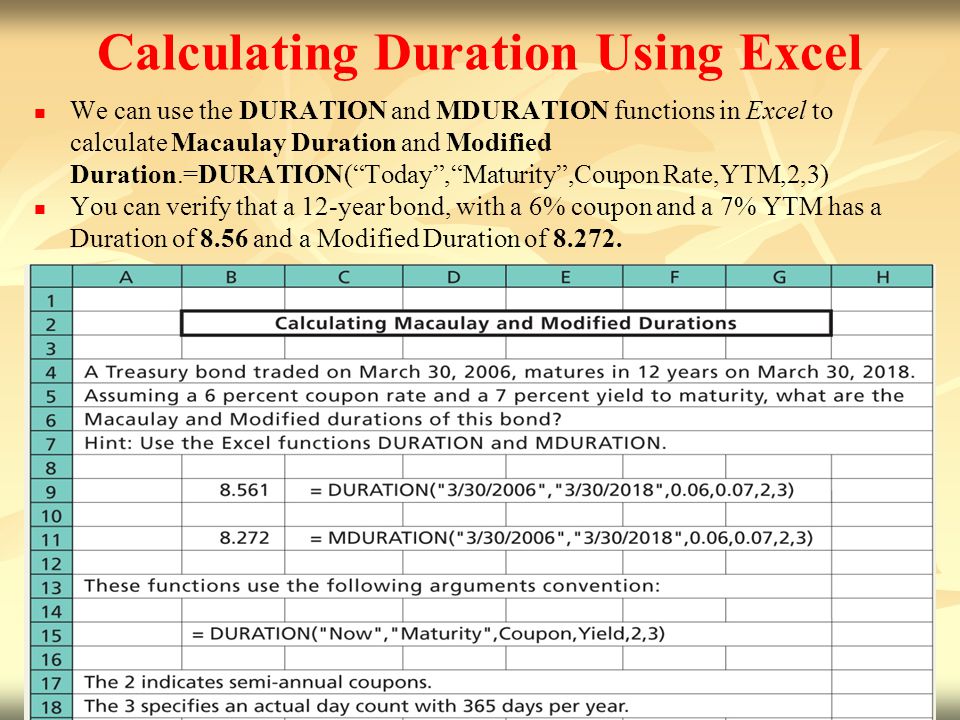

Bond Duration Formula Excel Example

Excel Ytm Calculator Calculator Spreadsheet Free Download

As you see, cell A1 contains the formula =ds(;;A10B12), which takes three input arguments and returns the text &YldCrv_A111 The prefix & indicates that &YldCrv_A111 is the handle name of some object In fact it points to an object of type Yield Curve and can be used in any context where a yield curve is needed, such as in pricing of optionsThis formula can be rearranged to give the number of payments n The bond pricing equation cannot be rearranged to give an explicit equation for the interest rate Numerical techniques are required to backsolve the equation for the yield to maturity, given the coupon, face value and payment frequencyThis article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

Excel For Finance Top 10 Excel Formulas Analysts Must Know

Or if you want to make it simpler, you can goYield to Maturity (YTM) Formula Excel Template Prepared by Dheeraj Vaidya, CFA, FRM visit email protected Particulars Values Face Value of Bond (F) 1000 Annual Coupon Rate 8% No of years in Maturity (n) 12 Price of the Bond (P) 940 Annual Coupon (C) 8000 Yield to Maturity 876% Assume that the price of the bond is $940 with the face valueI'm looking for a formula that gives me the current yield to maturity (YTM) for a bond, that takes into account the frequency of coupon (Monthly, SemiAnnual or Annual) and the effect of compound interest For example A1 = Today () B1 = Maturity Date C1 = Coupon (M, S, A) D1 = Present Value

Cd Ladder Calculator Spreadsheet Excel Sarahdrydenpeterson

Q Tbn And9gcs8pllmjk Cwco2cxddqmohomgedhyw Veiacyoq Lypi38bu2o Usqp Cau

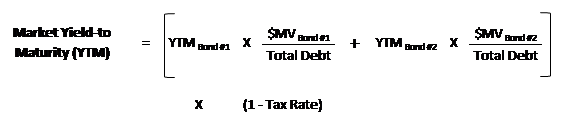

YieldtoMaturity (YTM) Formula for Bonds using Microsoft Excel;Yield to Maturity Err523 Bond Price (as a negative number) ($969) Coupon Payment ($1,) Face Value $000 Number of Coupon Payments Yield to MaturityThe following example shows how to calculate the yield on a bond purchased on August 8, 19, with maturity date of February 2 nd 24 The annual rate of interest is 50% on the price per $100 face value is $101, and the redemption value is $100 The payments will be made based on the US (NASD) 30/360 day count Download Workbook

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Ytm Formula Excel

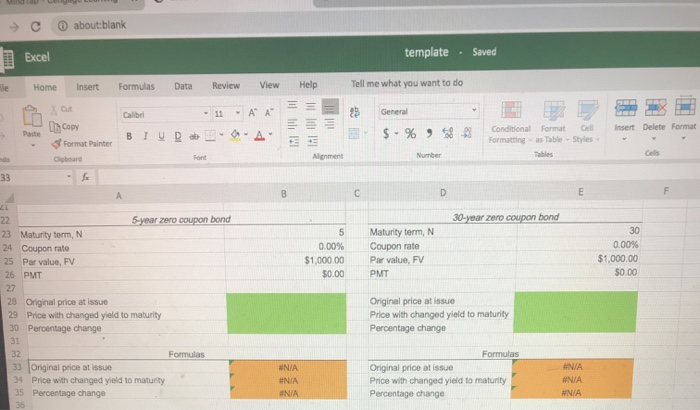

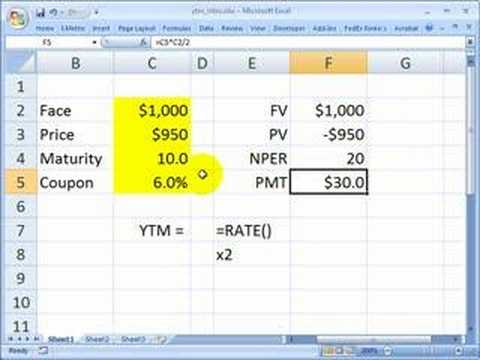

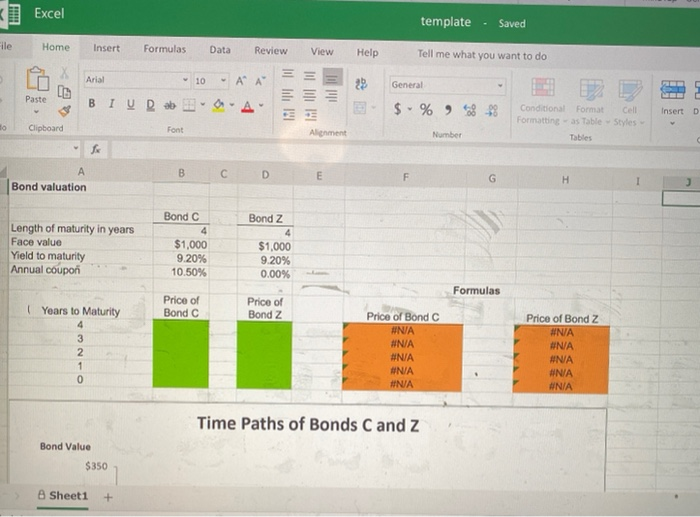

Excel formulas for bonds 1 3% Excel Formula Number of Payments #NUM!Calculating bond's yield to maturity using excel Calculating bond's yield to maturity using excelYield to Maturity Type This Bond Valuation spreadsheet distinguishes between the Annual Percentage Rate and the Effective Annual Rate When people talk about yield to maturity, they typically refer to the Annual Percentage Rate The Effective Annual Rate basically takes into account the effect of compounding interests of the coupons Output

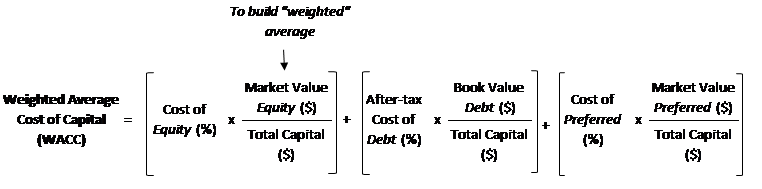

Weighted Average Cost Of Capital Guide Wacc Calculator Excel Download

Q Tbn And9gctyme8ik 5rvvlt9s8xo8oivzwss2eswopa7suqbophtfltdj98 Usqp Cau

YTM formula or yield to maturity equation is utilized to figure the yield on a security bond on the basis of its current market price The yield to maturity formula takes in to account the viable yield of a bond using compounding technique rather than the basic yield which can be calculated by utilizing dividend yield formulaYield to Maturity is the internal rate of return (IRR) from buying the bond at its current market price and holding it to maturity Assumption #1 You hold the bond until maturity Assumption #2 The issuer pays all the coupon and principal payments, in full, on the scheduled datesThe YIELDMAT function returns the annual yield of a security that pays interest at maturity In the example shown, the formula in F5 is = YIELDMAT(C9, C7, C8, C6, C5, C10) with these inputs, the YIELDMAT function returns 0081 which, or 810% when formatted with the percentage number format

1

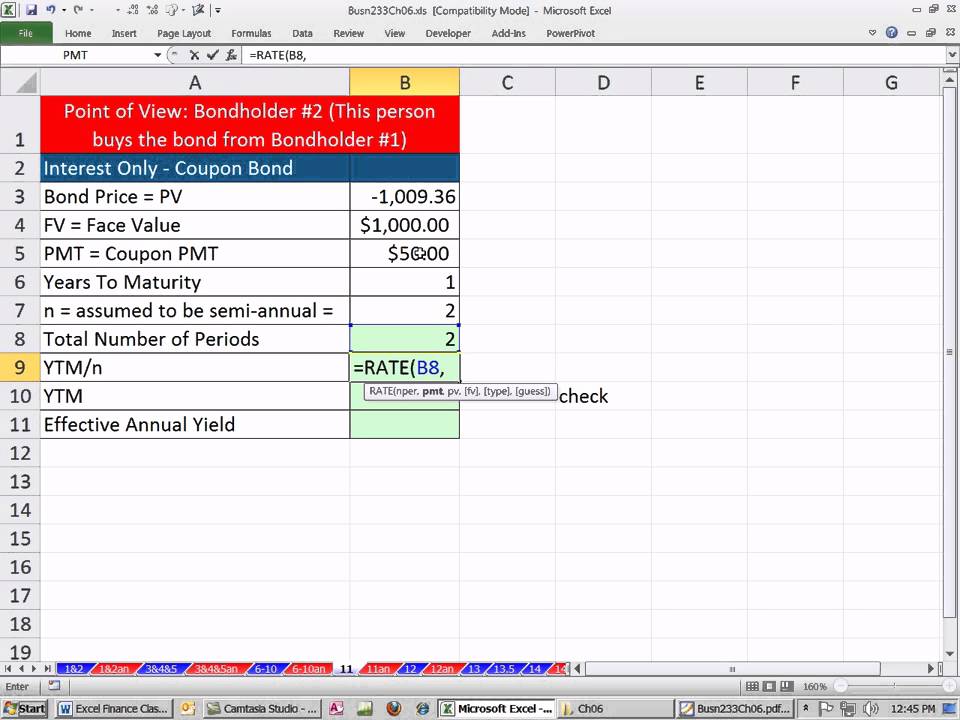

Excel Finance Class 48 Calculate Ytm And Effective Annual Yield From Bond Cash Flows Rate Effect Youtube

Rate = Nominal coupon interest rateYield can also be represented in the form of current yield Let's again look at our yield to maturity example to understand what is the current yield Current yield, by definition, is the annual rate of return that you receive for the price paid for that bond The formula of current yield Coupon rate / Purchase priceYIELD is an Excel function that returns the yield to maturity of a bond given its coupon rate, current price, principal amount and coupon payment frequency per year In the context of debt securities, yield is the return that a debtholder earns by investing in a security at its current price

Yield To Maturity Formula Step By Step Calculation With Examples

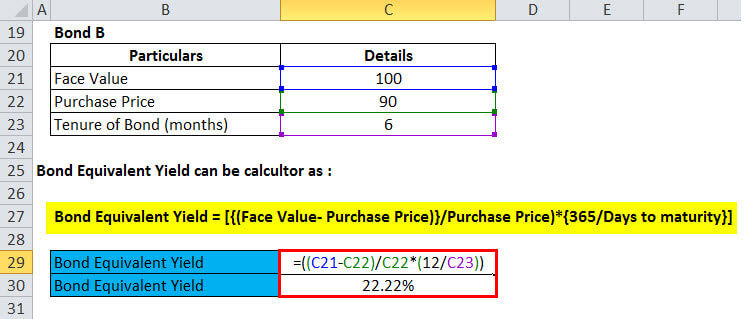

Bond Equivalent Yield Formula Calculator Excel Template

Yield to maturity can be mathematically derived and calculated from the formula YTM is therefore a good measurement gauge for the expected investment return of a bond When it comes to online calculation, this Yield to Maturity calculator can help you to determine the expected investment return of a bond according to the respective input valuesThe Bond Yield Calculator for Excel or Open Office Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturityYTM = Yield(settlement, maturity, rate, price, redemption, frequency, basis) All dates are expressed either as quotes or as cell references (eg, "1/5/13", A1) Settlement = Settlement date;

Yield Function Formula Examples Calculate Yield In Excel

Where Can One Download The Historical Interest Rate Yields Of Treasury Bonds Quora

Yrs to maturity 580 Excel calculation for yield show 3426% (using YIELD(settlement,maturity,rate,pr,redemption,frequency,basis) When you ask a question about Excel usage, it is important to show us how you are using Excel the actual formulas and constantsYield to maturity can be mathematically derived and calculated from the formula YTM is therefore a good measurement gauge for the expected investment return of a bond When it comes to online calculation, this Yield to Maturity calculator can help you to determine the expected investment return of a bond according to the respective input valuesYield to maturity (YTM) is the annual return that a bond is expected to generate if it is held till its maturity given its coupon rate, payment frequency and current market price Yield to maturity is essentially the internal rate of return of a bond ie the discount rate at which the present value of a bond's coupon payments and maturity value is equal to its current market price

Wacc Formula Calculation Example Wall Street Prep

Floating Rate Notes Frn In Excel Understanding Duration Discount Margin And Krd Resources

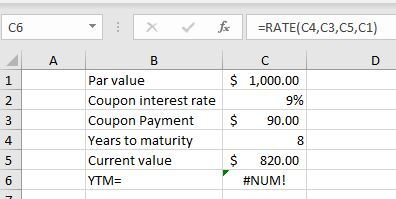

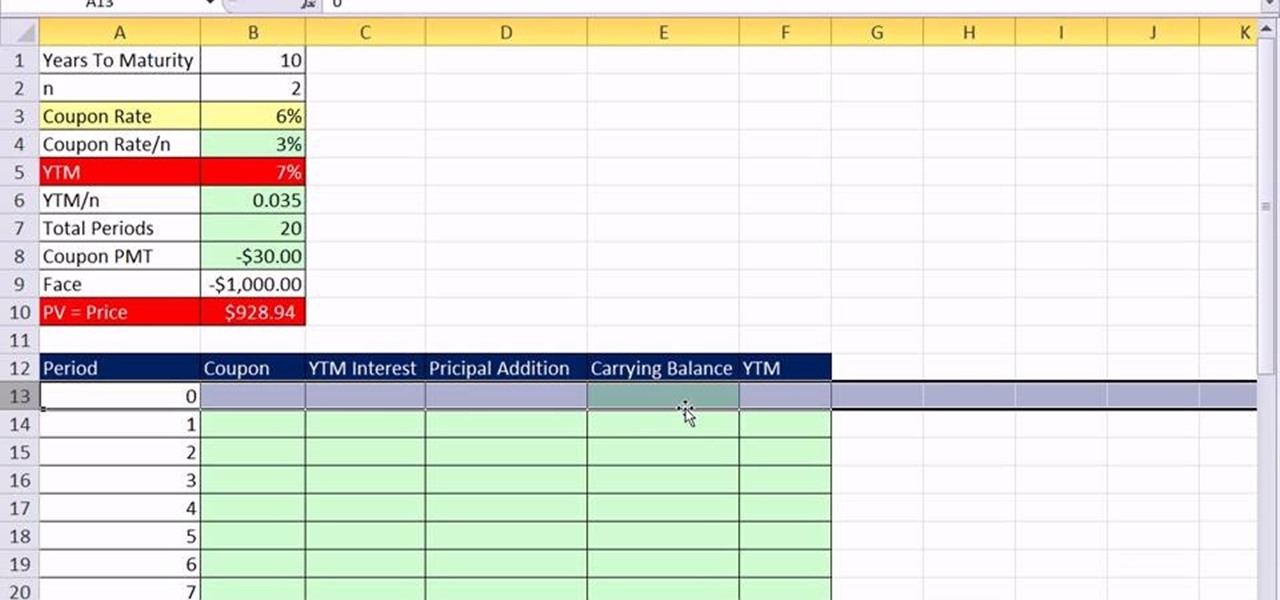

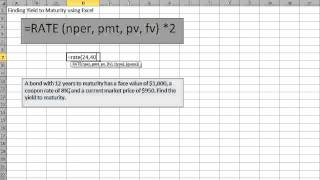

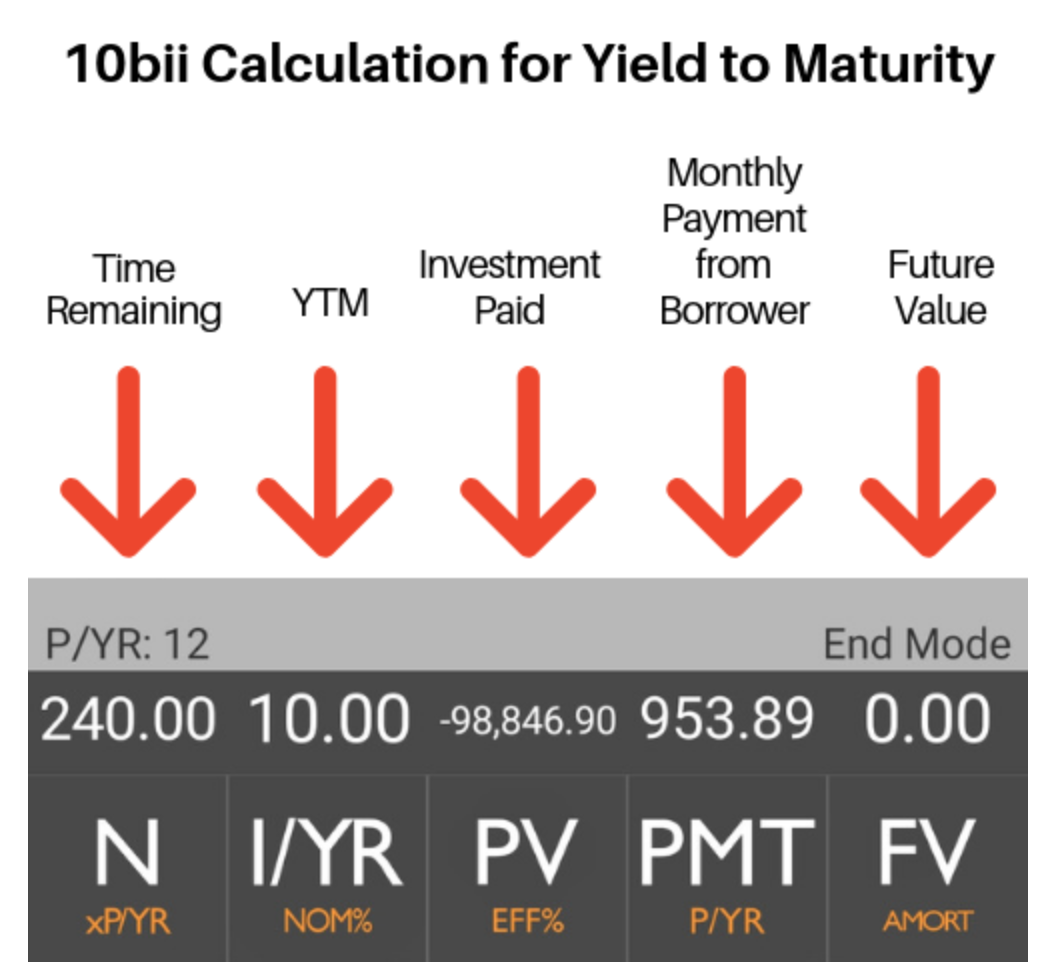

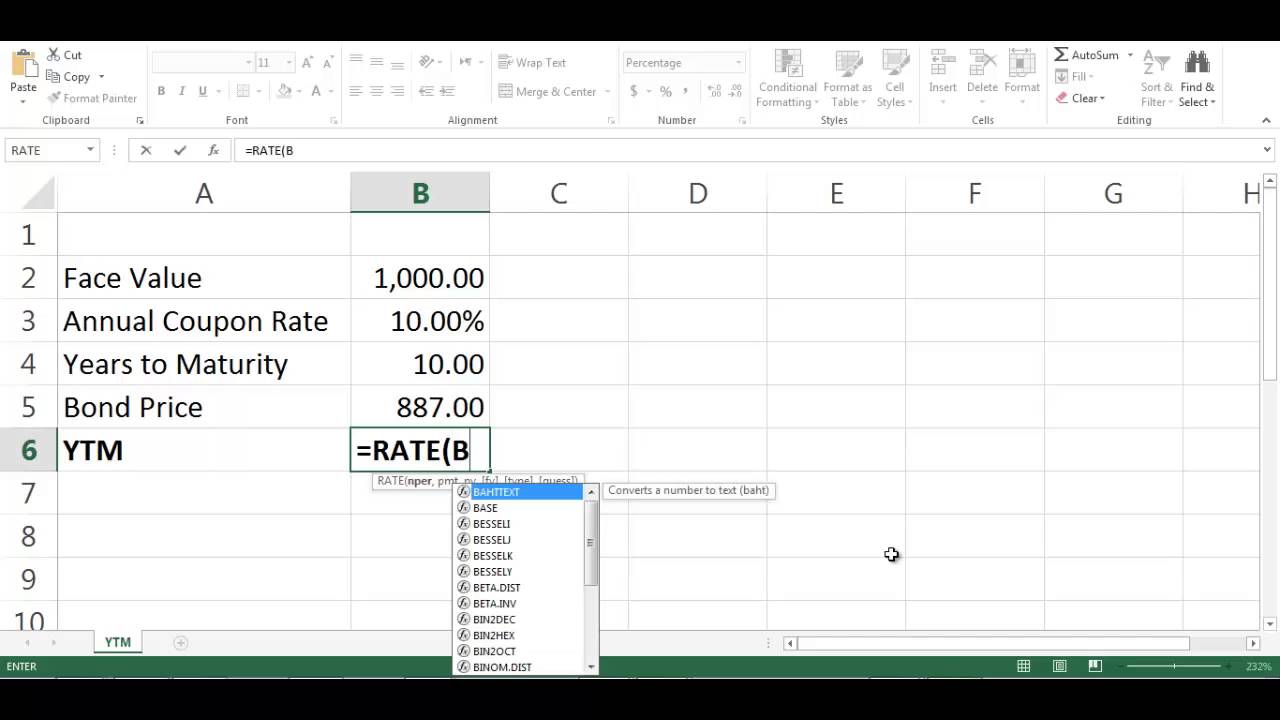

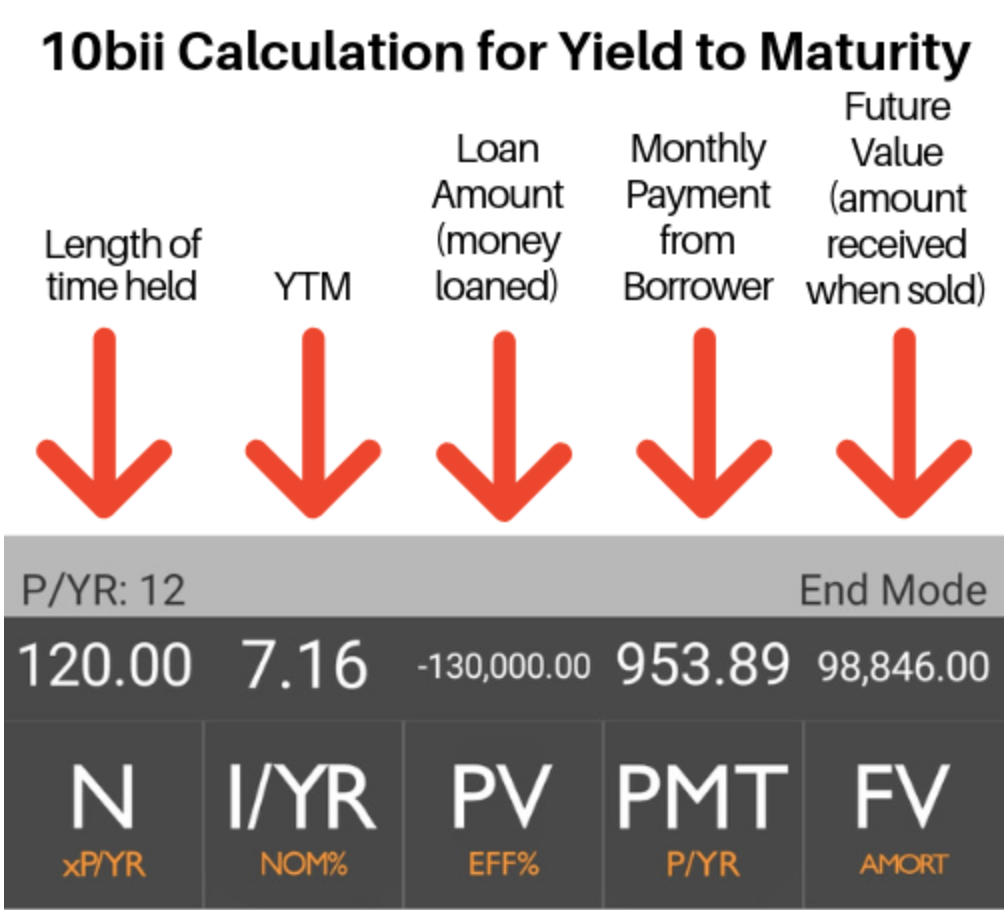

You can use Excel's RATE function to calculate the Yield to Maturity (YTM) Check out the image below The syntax of RATE function RATE (nper, pmt, pv, fv, type, guess) Here, Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10Maturity = Maturity date;Step by Step Calculation of a Bond The calculation of the bond can be understood in the following steps Step 1 – Calculate the coupon cash flows depending upon the frequency, which could be monthly, yearly, quarterly, or semiannually Step 2 – Discount the coupon by relevant yield to maturity rate

Explained How To Calculate Yields On Your Bond Investments

How To Use The Excel Yieldmat Function Exceljet

Freeware 10 Excel Sheet Unlocker Downloads at Download That The Bond Yield to Maturity calculator for Excel and OpenOffice Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity Bond Yield Calculator, Corrupt xlsx2csv, BulkPDFThe bond yield equation is a simple calculation technique when compared to the yield to maturity It is straightforward and clear Moreover, it ignores the time value of money and matured value Recommended Articles Download Bond Yield Formula Excel Template Enter Email Address xExcel Yieldmat Function Example In the following spreadsheet, the Excel Yieldmat function is used to calculate the annual yield for a security purchased on 01Jan17, with issue date 01Jul14 and maturity date 30Jun18 The interest rate at date of issue is 55% and the security has a price of $101 per $100 face value

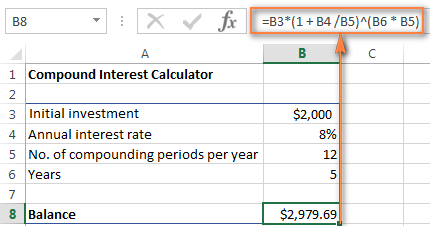

Compound Interest Formula And Calculator For Excel

Explained How To Calculate Yields On Your Bond Investments

Exceltemplatesorg – For investors, Bond Yield to Maturity Calculator is an important tool which can assist them in calculating their earnings once they have bought today's bond This calculator can be made by putting on the required data and formulas manually in Microsoft Excel worksheets;Unless you are using Excel 07, you will need to make sure that addin is installed (go to Tools » Addins and check the box next to Analysis ToolPak) The Price() function is defined as PRICE(settlement,maturity,rate,yld,redemption,frequency,basis)Excel Yieldmat Function Example In the following spreadsheet, the Excel Yieldmat function is used to calculate the annual yield for a security purchased on 01Jan17, with issue date 01Jul14 and maturity date 30Jun18 The interest rate at date of issue is 55% and the security has a price of $101 per $100 face value

Bond Yield Formula Calculator Example With Excel Template

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Amortization Formula in Excel (With Excel Template) Amortization Formula Amortization refers to paying off debt amount on periodically over time till loan principle reduces to zero Amount paid monthly is known as EMI which is equated monthly installment EMI has both principal and interest component in it which is calculated by amortizationStep 4 Next, figure out the yield to maturity of the bond based on the current return expected from securities with similar levels of risk The yield to maturity is denoted by Y Step 5 Next, figure out the number of periodic payments made during the year and it is denoted by n It is analogous to the number of compounding per year

Best Excel Tutorial How To Calculate Ytm

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield To Maturity Formula Step By Step Calculation With Examples

Bond Yield Price Drone Fest

Best Excel Tutorial How To Calculate Yield In Excel

Function Price

Calculating A Bonds Capital Gain Yield After 1 Year Using Excel Dubai Khalifa

Learn To Calculate Yield To Maturity In Ms Excel

Effective Interest Rate Method Excel Template Free Exceldemy

Datacenter Safefrankfurt De Datacenter Documents Bloomberg Terminal Primer Pdf

Note Please All Answers Must Be In Excel Formula X 5 X Home Calculating Homeworklib

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

Deriving The Bond Pricing Formula

Learn To Calculate Yield To Maturity In Ms Excel

Get Wacc Formula In Excel Free Excel Spreadsheets And Templates

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

Yield To Maturity Calculation In Excel Example

Bond Yield To Maturity Calculator Exceltemplates Org

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Vba To Calculate Yield To Maturity Of A Bond

Understanding The Yield To Maturity Formula Sofi

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Bond Yield In Excel 7 Steps With Pictures

10 Bond Prices And Yields Ppt Video Online Download

How To Calculate Bond Price In Excel

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Solved Excel Online Structured Activity Interest Rate Se Chegg Com

Calculating The Constant Yield Using Excel Gaap Logic

Weighted Average Cost Of Capital Guide Wacc Calculator Excel Download

Trade Discount Calculator

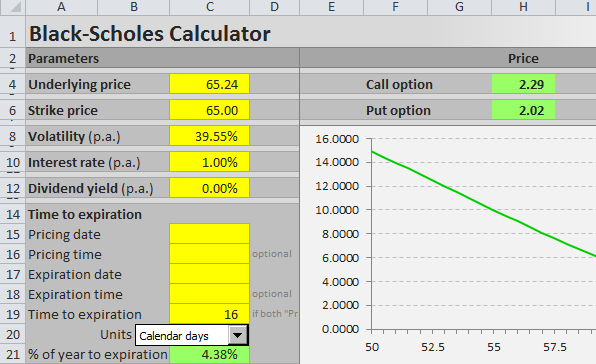

Black Scholes Excel Formulas And How To Create A Simple Option Pricing Spreadsheet Macroption

Bond Yield Calculator Excel Model Eloquens

Excel Help Calculating Yield To Maturity For A Bond

Yield To Maturity Formula Step By Step Calculation With Examples

How To Calculate Yield To Maturity 9 Steps With Pictures

How To Create A Bond Discount Or Premium Amortization Table In Excel Microsoft Office Wonderhowto

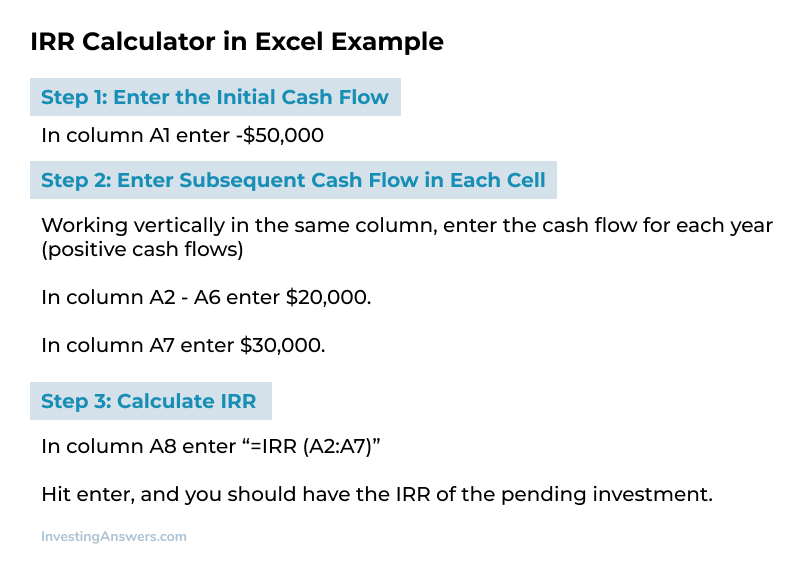

How To Calculate Irr In Excel A Financial Calculator

How To Solve For A Bond Yield To Maturity By Creating A Template In Excel Excel Excel Templates Solving

Microsoft Excel Bond Valuation Tvmcalcs Com

Finding Yield To Maturity Using Excel Youtube

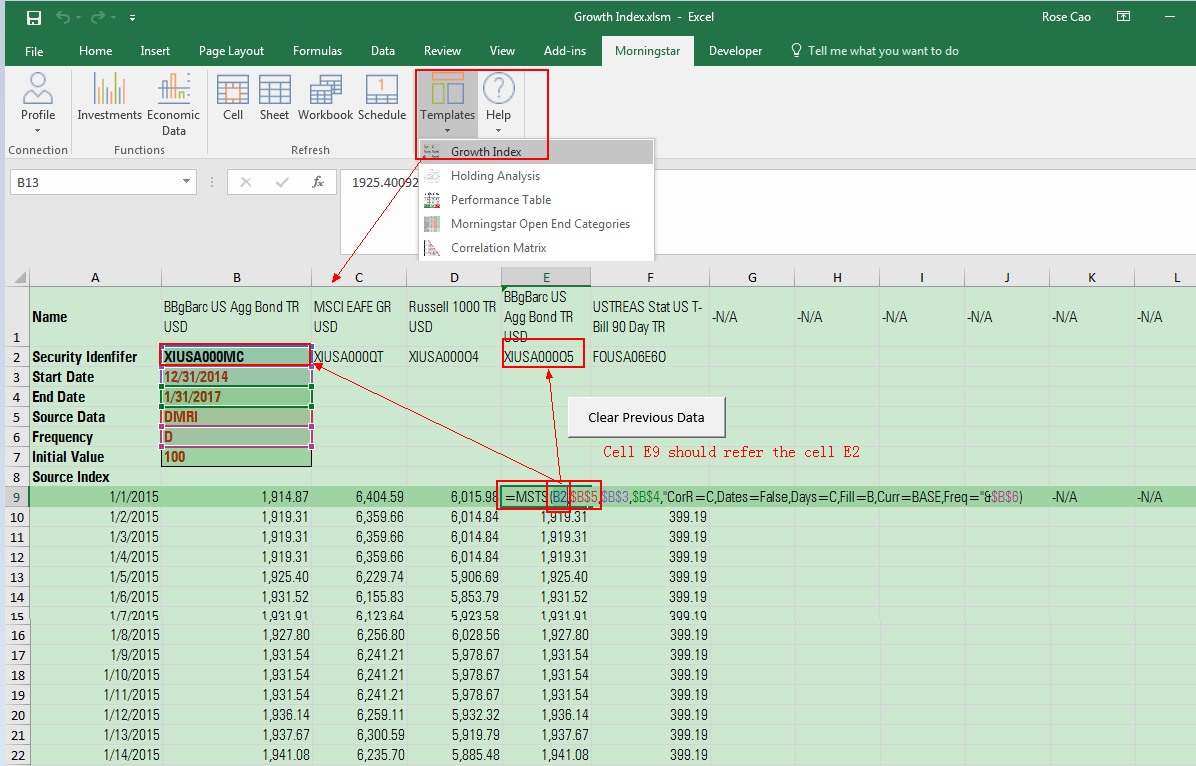

Morningstar Excel Add In

What Is Yield To Maturity Ytm Millionacres

Yield To Maturity Approximate Formula With Calculator

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Use The Excel Yield Function Exceljet

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Chapter 12 Conducting Stress Tests Of Defined Benefit Pension Plans A Guide To Imf Stress Testing Methods And Models

How To Calculate Yield To Maturity Studocu

Duration And Convexity For Us Treasuries Financetrainingcourse Com

Calculate Implied Volatility In Excel And Vba Through Step By Step

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

Function Duration

Free Bond Duration And Convexity Spreadsheet

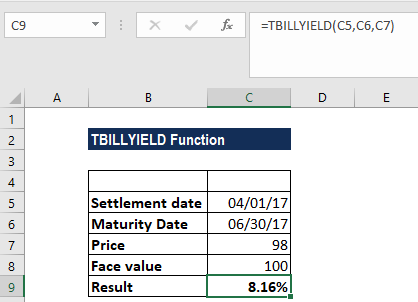

Tbillyield Function Formula Examples Calculate Bond Yield

Calculating Bond S Yield To Maturity Using Excel Youtube

How To Use The Excel Duration Function Exceljet

How To Calculate Pv Of A Different Bond Type With Excel

Bond Yield To Maturity Calculator Exceltemplates Org

What Is Yield To Maturity Ytm Millionacres

Parametric Yield Curve Fitting To Bond Prices The Nelson Siegel Svensson Method Resources

Bond Net Yield To Maturity Calculator Eloquens

Bond Yield Formula Laptrinhx

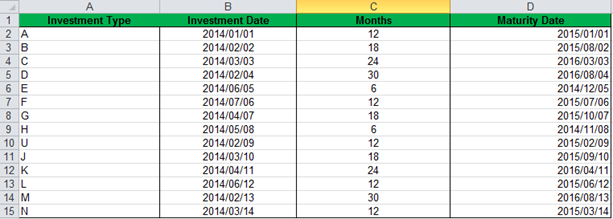

How To Calculate The Maturity Date Of An Investment

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Calculating The Constant Yield Using Excel Gaap Logic

Solved An Investor Has Two Bonds In Her Portfolio Bond C Chegg Com

Pdf 400 Excel Formulas List Excel Shortcut Keys Pdf Download Here

Bond Yield To Maturity Excel Formula Cells In Blue Are Course Hero

Bond Yield Formula Calculator Example With Excel Template

Creating A Yield Curve In Excel Download Scientific Diagram

Free Bond Valuation Yield To Maturity Spreadsheet

コメント

コメントを投稿